crypto is merely a transfer of wealth: normies -> ct -> vcs and kols > founders airdrops are a small relief to ct, it allows the top 5% of ct to grab some of the transfer of wealth back, so sell your airdrops shortly after tge or you are back in line

The MegaETH Public Sale: A Reminder to Stand on Business

The word "community" on its own has never made sense to me in crypto. What community are you referring to? What is the difference between a community member and a user? What traits define these so-called community members?

Back then, a community member was clearly someone who:

- believed in the protocol's thesis

- owned the protocol's asset

This held true across major protocols in our industry, from Ethereum and its global chapters led by ICO participants to the LINK Marines and the Solana Manlets. A complicated regulatory landscape forced teams to pause public sales, which had a clear distribution dynamic, and to explore airdrop systems. These airdrops aimed to make users the primary stakeholders of the protocol, but the muddied incentives produced only a few breakout successes. I do not believe an airdrop farmer, mercenary by nature, believes in the protocol or wants to meaningfully contribute.

Our approach is different. We want to build a community composed of people who show conviction in our thesis by purchasing and using the asset.

I believe there are three buckets of stakeholders here:

- $MEGA Investors: people who believe in Mega Labs' thesis in designing the protocol (building the best execution layer for crypto by centralizing block production and decentralizing block validation) and want to accumulate the protocol's token, $MEGA.

- Users: people who use the protocol, directly or indirectly, even without token incentives. This is why we built @0xMegaMafia

- Users THAT ALSO WANT TO BE INVESTORS: people who use the protocol, like it, and choose to become active investors in the $MEGA token.

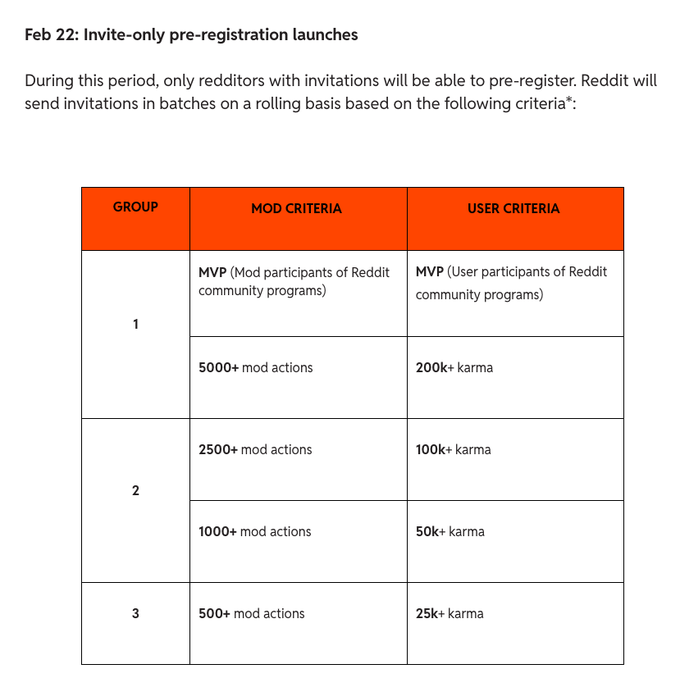

This model has played out before in web2 through Reddit. Reddit raised money from VCs. It had millions of users who used it with no expectation of profit. As it prepared for its IPO, it offered a directed share allocation to subreddit moderators and power users at the IPO price alongside institutional investors. @balajis described it as a DAO of sorts. Obviously, in the case of $MEGA we are discussing a token compared to equity, but the story is still worth sharing.

REDDIT'S IPO DAO Is Reddit becoming a DAO?!? Well, not exactly. But kind of. An underreported feature of the Reddit IPO is that they're decentralizing ownership. Early users can get in on the same terms as institutional investors, which is unusual: This is definitely a sign of

We are trying something similar with MegaETH.

MegaETH has raised money from investors such as Dragonfly and Vitalik Buterin, alongside more than 3,000 Echo users. The Fluffles were an attempt to curate the investor base by filtering for people who wanted to buy MEGA and who shared our values.

EXCLUSIVE: MegaETH developer raises $10 million in 3 minutes on Cobie's Echo theblock.co/post/330804/me…

Now, as we enter mainnet, a public sale is being launched with Sonar to create space for users (and potential users) who also want to be investors in $MEGA. This public sale will make non-insider investors the single largest stakeholder in the MegaETH network, larger than the VCs and the team.

The real community for MegaETH is its $MEGA investor community, many of whom will be active users and ecosystem supporters. This non-consensus sale will help identify those who believe in our non-consensus blockchain.

Why this Public Sale on Sonar is Unique

Firstly, you choose a valuation you believe is compelling.

The second component of the MegaETH public sale comes into play if there is an oversubscription at the clearing price.

On mainnet, we will have additional tokens up for grabs by those who attempted to participate in the Sonar, Echo and Fluffle sales.

Allocation Method for Oversubscribed Sales

If the sale is oversubscribed at the clearing price, a U-Shaped Allocation system will be used to prioritize broad distribution while rewarding key contributors.

The U-Shaped Allocation process ensures broad token distribution while prioritizing key contributors. MegaETH and Ethereum core supporters receive priority allocations, while at least 5,000 participants receive baseline allocations starting at $2,650.

Depth (Contributor Priority). Prioritized fills go to participants who've already contributed towards the development or growth of MegaETH and/or Ethereum.

Breadth (Community Floor). Majority of users receive smaller fills to maximize unique holders and true community distribution.

What counts as contribution (public signals that can be verified):

- MegaETH Culture: Proliferation and ownership of Mega-originated cultural icons (ex. @fimmonaci, @TheFluffleNFT, Breadio, @badbunnz_, @MegalioETH, Lemonheads, et al).

- Vocal supporters: Wallets linked to Twitter and Discord accounts that consistently advocate for the fundamentals of MegaETH and Ethereum. We will leverage our @KaitoAI leaderboard alongside @ethos_network and [] for QA.

- Onchain Exploration: Addresses that have dared to FAFO, ape in and are chronically onchain - with a bias towards 'early use' and 'consistency'. extra brownie points for being among the first 5,000 users to interact with contracts that gained real traction - such as, but not limited to: @compoundfinance, @ensdomains, @Uniswap, @CurveFinance, @Aave, @Lidofinance, @Pendle_fi, @Opensea, @StargateFinance, Eigenlayer and Ethena.

- Ethereum DeFi: Wallets with meaningful DeFi participation in the Ethereum ecosystem, a recent example being @capmoney_ (CAP) stablecoin program deposits

- Dope NFT ownership: @cryptopunksnfts, Autoglyphs, Fidenza, Hypurr, Pudgy Penguins, Quine by Larva Labs, @miladymaker, yapybara

Published: 10/22/2025